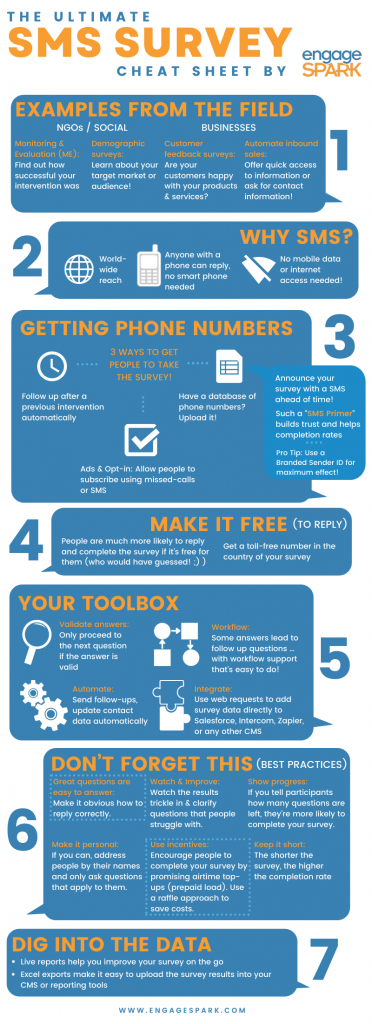

SMS Surveys are a great way to get feedback from customers, gather data from citizens, or run M&E follow-ups in collaboration with beneficiaries. Because text messaging surveys are such an important tool to businesses and NGO’s alike we’ve put together a lot of goodies in the following SMS Survey infograpic: answers to questions we’ve been asked many times, lessons we’ve learnt (sometimes the hard way), small best practices that can go a long way to make your text survey a success.

Any questions? Chat with us now!

1. Examples from the field

NGOs / social projects & businesses

- Monitoring & Evaluation (ME): How successful was your intervention?

- Demographic surveys: Learn about your target market or audience!

Businesses

- Customer feedback surveys: Are your customers happy with your products & services?

- Automate inbound sales: Offer quick access to information or ask for contact information!

2. Why SMS?

- You get world-wide reach: to (almost) every country in the world

- Anyone with a phone can reply—no smart phone needed!

- No mobile data or internet access needed

3. Getting phone numbers

The key to any SMS Survey is the phone numbers. There are 3 ways for people to join the survey

- Do you have a database of phone numbers? Great, then just upload it and contact those people! (Your survey may surprise people. See below how to help that.)

- Ads & Opt-in: Allow people to subscribe using missed-calls or SMS

- Follow up after a previous intervention automatically using scheduled campaigns or our subscription API

In some scenarios, people don’t expect to be contacted for a surveys, which makes them less likely to respond. Since any question SMS sent is money spent, building trust and setting expectations is key to improving completion rates. Here is how you can do it. (It’s really simple.)

- Announce your survey with a SMS ahead of time!

- Such a “SMS Primer“ builds trust and helps completion rates

- Pro Tip: Use a Branded Sender ID for maximum effect!

4. Make it free (to reply)!

Here is a problem with 2-way SMS campaigns: it usually costs money to reply! And who loves to spend money to reply to a survey?

- People are much more likely to reply and complete the survey if it’s free for them

- Get a toll-free number in the country of your survey. (They help even for marketing campaigns!)

5. Your Toolbox

SMS Surveys are not just Q&A. Here are the tools you can look forward to when building a SMS Survey with engageSPARK.

- Validate answers: only proceed to the next question if the reply is valid. For example, only proceed if the response matches a given set of valid responses, or if it’s a number in a certain range.

- Automate: Send reminders when someone doesn’t reply to a question and update contact data automatically when they do.

- Workflow: Some answers lead to follow-up questions—with workflow support that’s easy to do! Generally, conditions are powerful: Ask some questions only to people over 50, or that have answered the fourth question with “yes“.

- Integrate: Use web requests (HTTP API with JSON) to add survey data directly to Salesforce, Intercom, Zapier, or any other CMS.

6. Don’t Forget This (Best Practices)

Here are a few lessons we learnt over the years of running surveys. Some aren’t surprising—but often surprisingly hard to stick to. Ask us if you struggle with your survey design!

- Great questions are easy to answer: Make it obvious how to reply correctly. This is so important that we wrote a whole article about how to ask questions well.

- Make it personal: If you can, address participants by their names. Only ask questions that apply to the specific person.

- Keep it short: The shorter the survey, the higher the completion rate.

- Use incentives: Encourage people to complete your survey by promising airtime top ups (prepaid load). Use a raffle approach to save costs.

- Show progress: Participants are more likely to complete your survey, if you tell them how many questions are left.

- Watch & Improve: Watch the results come in & clarify parts that survey participants struggle with.

7. Dig into the Data with Live Reports

- improve your survey on the go using live report data.

- Excel exports of the raw report data help you dig deep into the data and visualize it in the best way for you.