Case Study: Grameen Foundation

Grameen Foundation (GF) is a global nonprofit organization that aims to alleviate hunger and poverty by providing financial, health, and agricultural services to rural families, especially women.

In the Philippines, Grameen uses mobile technology as a catalyst to promote financial inclusion for the financially excluded and underserved women of the Philippines. Grameen has been making an impact in Filipinos’ lives since 2000, by both aiding microfinance institutions and expanding its services to the poor communities of the country.

Background

Grameen Foundation (GF) has been collaborating with engageSPARK for over three years using SMS messaging in two of its programs in the Philippines: FarmerLink and WomenLink. This case study focuses mainly on Grameen’s WomenLink program, “WOMENLINK PHASE 1: Empowering women through financial inclusion in the Philippines”.

WomenLink, funded by Wells Fargo, is a 3-year program stretched over 3 phases that aims to conduct a financial literacy campaign via a series of scheduled SMS text messages to low-income women—most of whom manage their households’ finances—and educate them on different Digital Financial Services (DFS) available in their region. For Phase 1, Grameen’s five local institutional implementing partners are Ahon sa Hirap, Inc. (ASHI); Agusan del Norte Teachers, Retirees, Employees and Community Cooperative (ANTRECCO); Caritas Banco ng Masa (BNM); Opportunity Kauswagan Remit (OK Remit); and Action.Able, Inc (Posible).

Grameen’s goal was to reach 20,000 women. Grameen tapped into these 5 partners’ pool of female clients to be enrolled into the program’s automated educational SMS Blast campaign. The average woman in the program was 39 years old, 69% were married, 44% were housewives, and 97% owned a mobile phone:

(The Case of Grameen Foundation’s WomenLink Program, p. 5)

(The Case of Grameen Foundation’s WomenLink Program, p. 5)

After collating the female participants’ mobile numbers, Grameen forwarded the database of contacts to engageSPARK to validate[1] whether the numbers are valid, active, invalid, or deactivated.

Grameen started Phase 1 by conducting a usability study in December 2017 to understand the drivers motivating low-income women to use DFS platforms and the barriers that prevent them from using those platforms. The study uncovered five main barriers:

- Lack of trust in DFS combined with low levels of digital financial literacy and skills cause apprehension towards adoption.

- Limited range of transactions offered by DFS platforms due to lack of merchants and commercial establishments accepting mobile money discourages regular usage of DFS.

- Weak and intermittent network connection in certain rural regions make DFS unreliable at times

- Difficulty in setting up personal mobile accounts due to strict KYC and registration processes hinders DFS uptake especially for those without identification documentation.

- Insufficient tutorials on DFS interface and user experience is problematic for customers not used to navigating through smartphone applications. (The Case of Grameen Foundation’s WomenLink Program, p. 1)

Results

Powered by the insights gathered from the study and with the help of engageSPARK’s SMS and Voice IVR platform, Grameen launched its automated SMS-based financial literacy campaign in June 2018 to over 21,900 women across five different regions in the country – Bulacan, Batangas, Aklan, Antique, and Agusan del Norte. Grameen designed the SMS content to “deliver simple but actionable messages to deepen women’s understanding of DFS” and centered towards money-saving tips, information on financial products and digital services, and promotional messages from their DFS partners.

They sent out weekly SMS blasts to women enrolled in the program totaling to 280,977 SMS sent throughout the course of 6 months that ended in December 2018 with an estimated SMS cost of $4,400.

The SMS-based financial literacy campaign received overall positive feedback from the participants with one participant saying, “The text messages are helpful reminders to ensure we’re managing our finances wisely. My favorite is the last one I received. It says that we must have control over our money. I agree!”

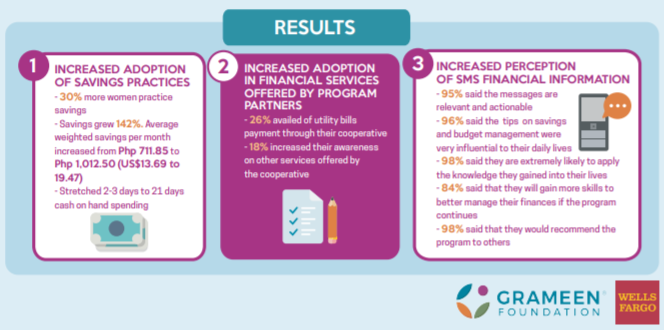

The programs key results show a positive change in behavior in terms of money-saving habits, an increase in adoption of financial services, and an overall positive perception towards financial information sent via SMS.

Key Results

1. Increased Adoption of Savings Practices

-

-

- 30% more women practice savings

- Savings grew 142%. Average weighted savings per month increased from Php 711.85 to Php 1,012.50 (US$13.69 to 19.47)

- Stretched 2-3 days to 21 days cash on hand spending

-

2. Increased Adoption in Financial Services Offered by the Program Partners

-

-

- 26% availed of utility bills payment through their cooperative

- 18% increased their awareness on other services offered by the cooperative

-

3. Increased Perception of SMS Financial Information

-

-

- 95% said the messages are relevant and actionable

- 96% said the tips on savings and budget management were very influential to their daily lives

- 98% said they are extremely likely to apply the knowledge gained into their lives

- 84% said that they will gain more skills to better manage their finances if the program continues

- 98% said that they would recommend the program to others

-

(Womenlink Phase 1 Infographic)

(Womenlink Phase 1 Infographic)

Conclusion

Through engageSPARK’s SMS and Voice IVR platform, Grameen was able to educate and improve the lives of over 21,900 low-income women across the country by sending them weekly SMS reminders about the importance of financial management and the benefits of DFS.

The positive feedback from the participants encouraged Grameen to continue using engageSPARK’s automated SMS platform for Womenlink’s Phase 2 that started in January 2019 and is set to end in December 2019. Phase 2 of the program taps a new batch of 20,000 low-income women.

[1] engageSPARK offers phone number validation as a service to remove invalid and deactivated numbers from your contacts database. This helps you avoid wasted effort and money by making sure that you are only reaching out to valid and active numbers.

How It Works: