engageSPARK for

Microfinance Institutions (MFIs)

- Send Reminders

- Ask for Commitments

- React to Early Warning Signals

- Escalate Automatically

- Increase Your Repayment Ratios

(RR and OTR)

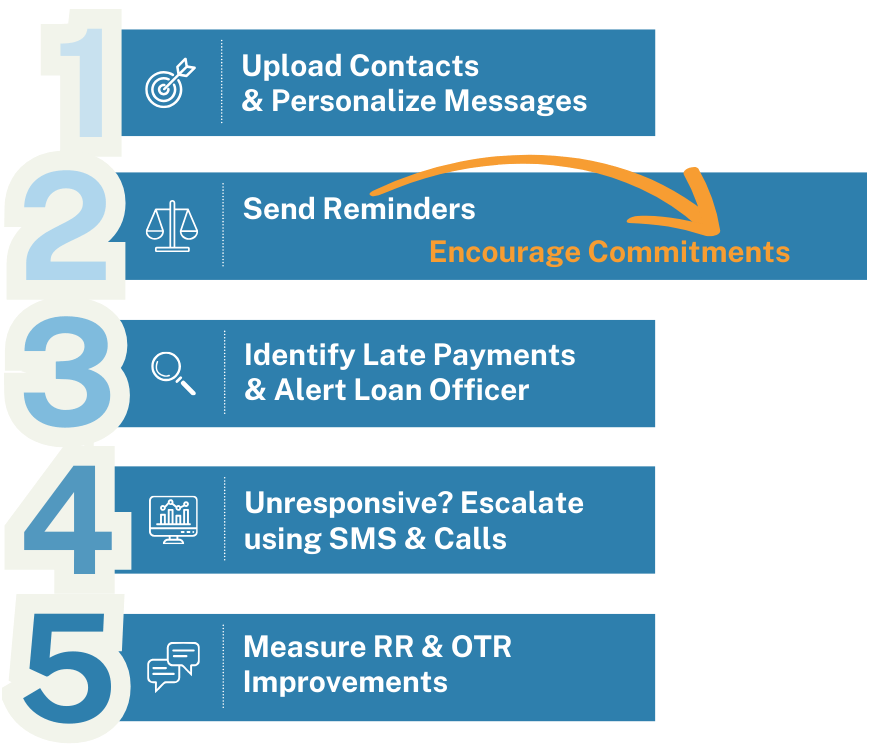

Discover the Process

Increase your Repayment Rate using reminders, commitments, escalations & early warnings.

Seamlessly switch between SMS, voice calls, and WhatsApp, and alert Loan officers automatically of looming late payments.

Send reminders

Ask for commitments

Many MFIs send reminders when the next installment is due. Some even personalize them to their borrowers.

Why not go a step further and ask each borrower when they’re going to pay, giving them options like 24/36/48/72 hours.

By committing to a specific and self-chosen time, RR rates can be increased significantly.

Research Spotlight! (Mazar et al., 2018)

In their 2018 paper, the authors show how IVR campaigns can be used to ask for personal and specific commitments.

And they show how these self-imposed commitments can positively impact repayments.

Title: If you are going to pay within the next 24 hours, press 1: Automatic planning prompt reduces credit card delinquency”

Authors: Nina Mazar, Daniel Mochon, Dan Ariely

Published in the Journal of Consumer Psychology

Read the paper at the Journal of Consumer Psychology or at SSRN.

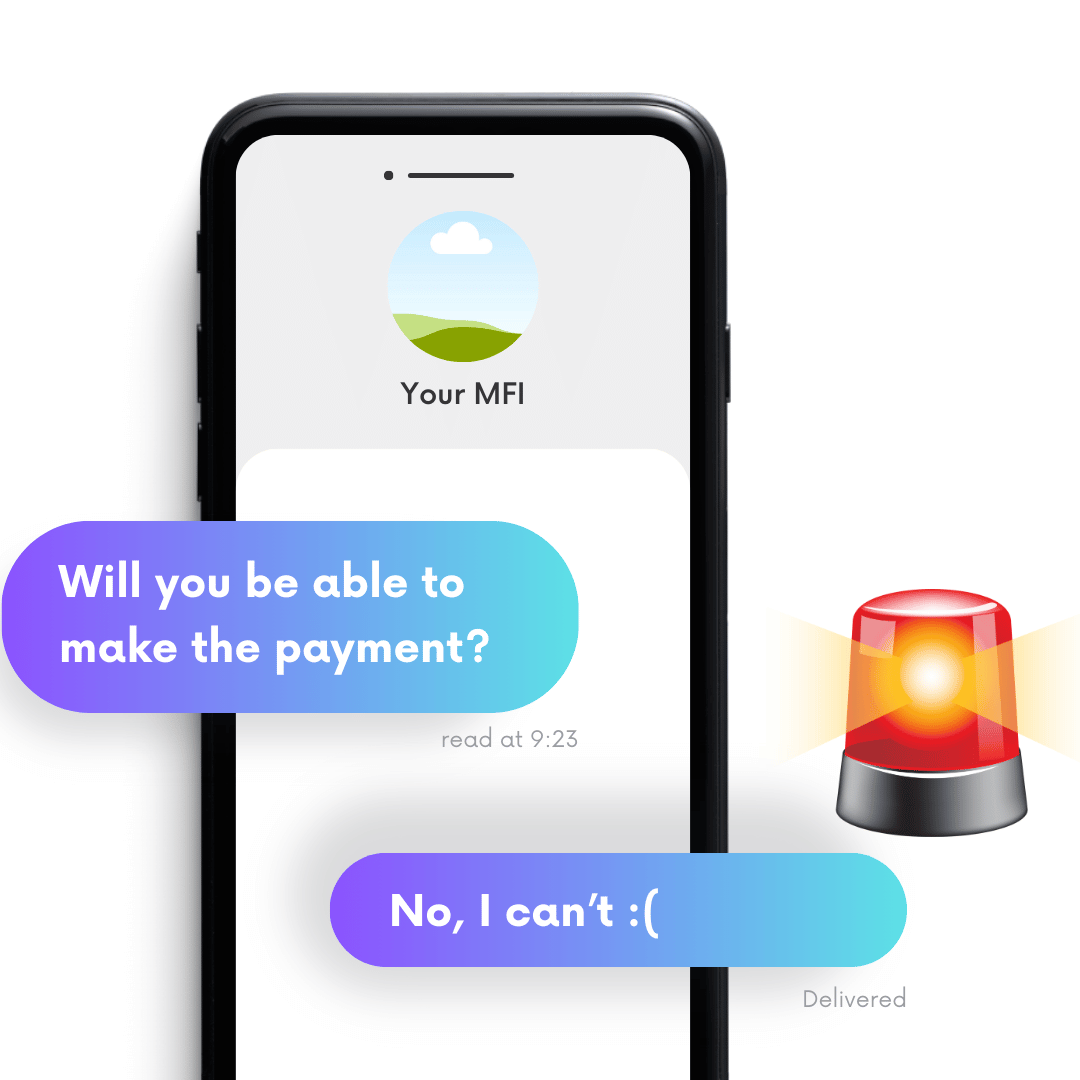

Catch early warnings

Flag looming late payments

Automatically:

- gather crucial data: ask for the reason of non-payment, and when the payment can be expected

- alert the corresponding loan officer with these details

No reply? Escalate!

Your messages fall on deaf ears? Perhaps mobile network issues?

Our built-in escalation gets you answers. For example, start with SMS, and fall back to automated voice calls. Or try WhatsApp first, then push with SMS at pre-set intervals. All automatically.

Available channels out of the box:

- SMS texts

- Voice calls

Integrate more with API & webhooks.

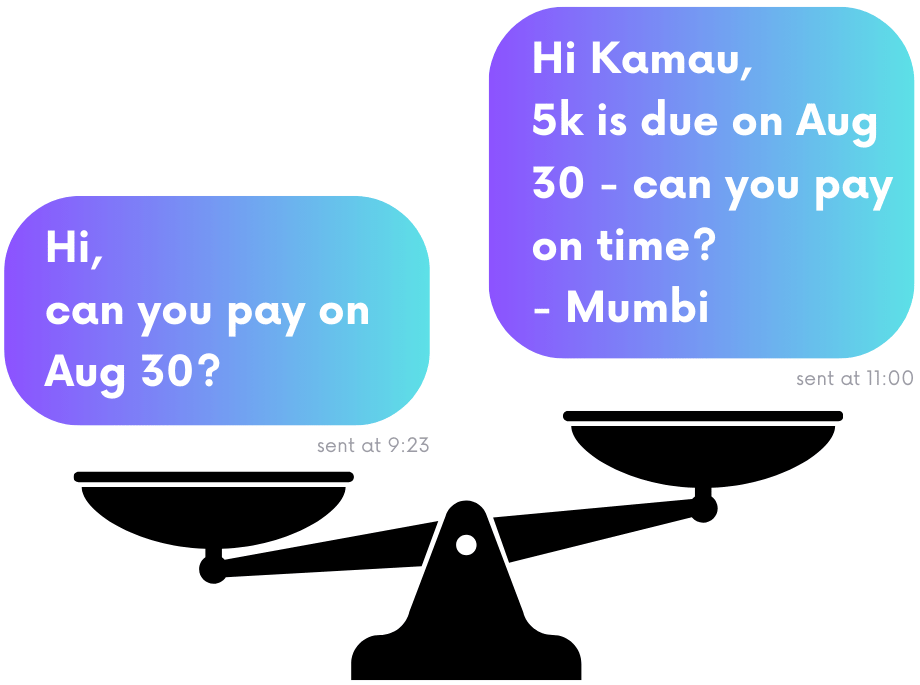

Customize nudges … and then A/B test them

What works for others might not work for you. Different countries and customers, even different policies and legal requirements.

That’s why it’s crucial that you can customize and adapt campaigns to your needs—something our platform is built for:

- Personalize messages, for example by including the borrowers name, the loan amount, etc.

- Why not try including the loan officer’s name? See Karlan et.al. below

- Schedule campaigns at different times

- Use different channels for different people

A/B test everything: test different approaches and compare results.

Research Spotlight! (Karlan et al., 2012)

In their 2012 paper, the authors observed that repayments of credit card debt increased significantly when the loan officer’s name is mentioned.

This may or may not apply to your specific scenario, but do have a read, it’s a fascinating study.

Title: “A Personal Touch: Text Messaging for Loan Repayment”

Authors: Nina Mazar, Daniel Mochon, Dan Ariely

Published at the National Bureau of Economic Research

Read the paper at the NBER.

What Our Customers Are Saying

“We love using the engageSPARK platform – it’s super user-friendly, the customer service is great, and we’re learning how to get high response rates!”

Kasia Stochniol, Director

60 Decibels, a leading impact measurement company spun out of Acumen, has completed hundreds of impact measurement projects in 80+ countries using engageSPARK.

How may we help you?

Let’s talk!

Open the chat and say hi. We’re happy to help.

Or drop us an email at sales@engagespark.com